Introduction

In the world of social housing, charging/funding exercises are often seen as transactional necessities - a means to secure capital, refinance debt, or support development ambitions. However, beyond the legal documentation and financial arrangements, can these exercises generate a valuable stream of data and documentation that housing associations can harness for strategic advantage?

The 2025 HACT Data Standards in Social Housing report in January 2025 highlighted the high cost of poor data across the sector, estimating over £400 million lost annually due to fragmented systems and unreliable information. This amount could instead fund the construction of more than 1,600 (!) typical social rent homes (based on an average build cost of £247,500 per 2-3 bed house).

This underscores the importance of treating data not just as a compliance requirement, but as a strategic asset. With the caveat of course, being, as a standard practice, any sensitive, confidential, or personal data must be protected and handled in accordance with data protection regulations and internal governance policies.

This blog explores the types of data housing associations can access following a charging/funding exercise, and how this information can support organisational resilience and growth.

Types of data available post-funding/charging

Data available following a charging/funding exercise typically falls into the following three key categories:

A. Asset-level data and documentation

| Land egistry data | Legal ownership, title numbers, tenure type, title restrictions, charges on the property, pending applications on the housing association’s title, the length of housing association’s leases, title defects. |

| Property documents | Title deeds, planning permissions, s106s, LA discharges of planning and s106 agreements, structural warranties and building regulation certificates, confirmation of highway and drainage adoption status, indemnity insurance policies |

| Valuation data | Valuation basis: EUV-SH (Existing Use Value for Social Housing) or MV-STT (Market Value Subject to Tenancy) |

| Energy efficiency data | EPC data is often required for sustainability linked loans |

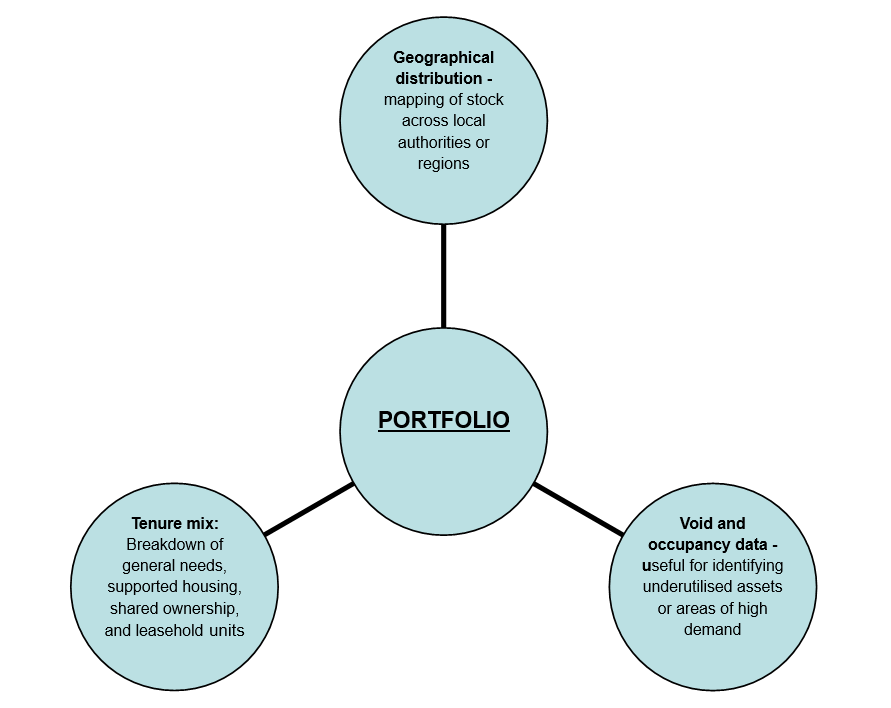

B. Portfolio composition

C. Data available from financial documentation

- Loan-to-value ratios: Based on updated valuations and outstanding debt and useful to determine if there is any room for further borrowing;

- Covenant compliance data: Metrics used by the lenders to assess financial health and risk and importantly for housing associations, to monitor covenant thresholds to avoid breaches.

So how can housing associations use this data?

Here are some ideas on how housing associations can make or continue to make the most of data gathering during a charging/funding exercise:

A. Strategic asset management

With updated valuations, tenure types, certificates of title, and condition data at hand, housing associations can:

- Identify underperforming or high-maintenance stock.

- Prioritise investment in areas with strong market value or development potential.

- Support decisions around disposal, regeneration, or tenure conversion.

- Identify properties with potential for valuation uplift to MV-STT.

- Flag ‘un-chargeable’ properties and assess potential for to rectify for future charging exercises.

B. Risk profiling and scenario planning

Funding exercises often involve housing associations undergoing stress testing and covenant analysis. These can be also repurposed to:

- Model financial resilience to simulate market/policy scenarios and test impact on cash flow and covenants

- Assess exposure by specific asset types, geographic areas, or funding structures and identify risk concentration

- Inform internal risk registers and develop targeted mitigation strategies.

C. Board reporting and governance

The structured nature of lender-facing data makes it ideal for:

- Updating asset and liability registers to ensure that these include accurate and up-to-date records of owned stock and any associated financial obligations.

- Enhancing board-level dashboards and/or performance reports.

- Providing useful evidence for strategic decisions and long-term planning.

D. Benchmarking and performance tracking

By comparing internal metrics with sector norms or previous funding rounds, housing associations can also:

- Track changes in asset value, void rates, or EPC performance.

- Benchmark financial ratios and covenant headroom.

- Spot trends that could inform future funding or investment decisions.

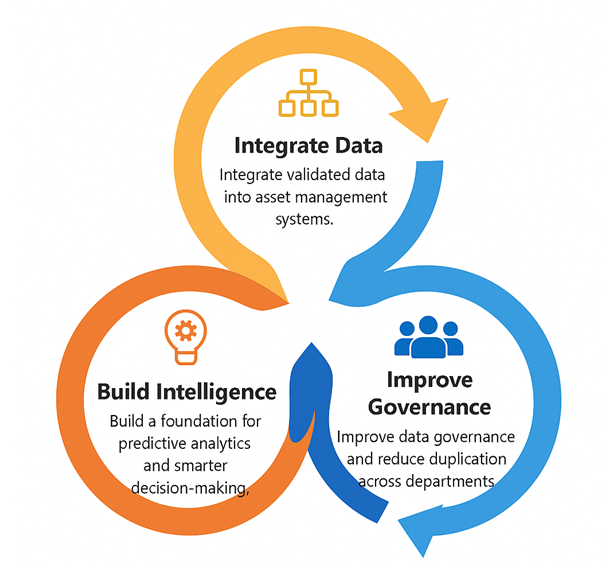

Data integration and digital transformation:

The exercise often prompts a clean-up of asset records and legal documentation. This is an opportunity to:

Conclusion

Charging/funding exercises present a unique opportunity to gather, validate, and leverage data that can inform strategic decisions long after the transaction is complete.

From asset-level insights and financial metrics to legal documentation and governance data, the information collected during these processes can support smarter asset management, stronger risk oversight and more transparent reporting. With the right tools, governance, and internal capacity, housing associations can turn this data from a compliance requirement into a strategic asset that drives resilience, efficiency, and long-term value for tenants and stakeholders alike.

The key is to treat the charging and funding exercises not just as ‘one-off’ financial events, but as data events offering various opportunities - and to build the culture, systems, and skills needed to make the most of them.

How we can help

We understand the challenges housing associations face in managing the volume and complexity of data generated through charging and funding exercises. We can support this by delivering tailored asset and liability registers and health checks of existing stock, to help housing associations collate valuable property data as well as prepare for future transactions. Whether you're preparing for a transaction or improving data quality for charging and funding exercises, we can offer practical, expert support to help you make the most of your data.

To discuss how we can help please contact me.

/Passle/5f4626f28cb62a0ab4152da6/MediaLibrary/Images/2025-12-17-10-09-17-976-6942814d6438b978e7e6e97f.png)

/Passle/5f4626f28cb62a0ab4152da6/MediaLibrary/Document/2026-02-19-14-08-41-119-ResponsetotheGovtcallforevidenceonco-operatives20301461.3_thumbnail_1.png)

/Passle/5f4626f28cb62a0ab4152da6/SearchServiceImages/2026-02-16-13-19-32-722-699319642a3147bfceeb00de.jpg)

/Passle/5f4626f28cb62a0ab4152da6/MediaLibrary/Images/2025-08-04-16-03-43-426-6890d9df3f59508dccf9f05f.jpeg)